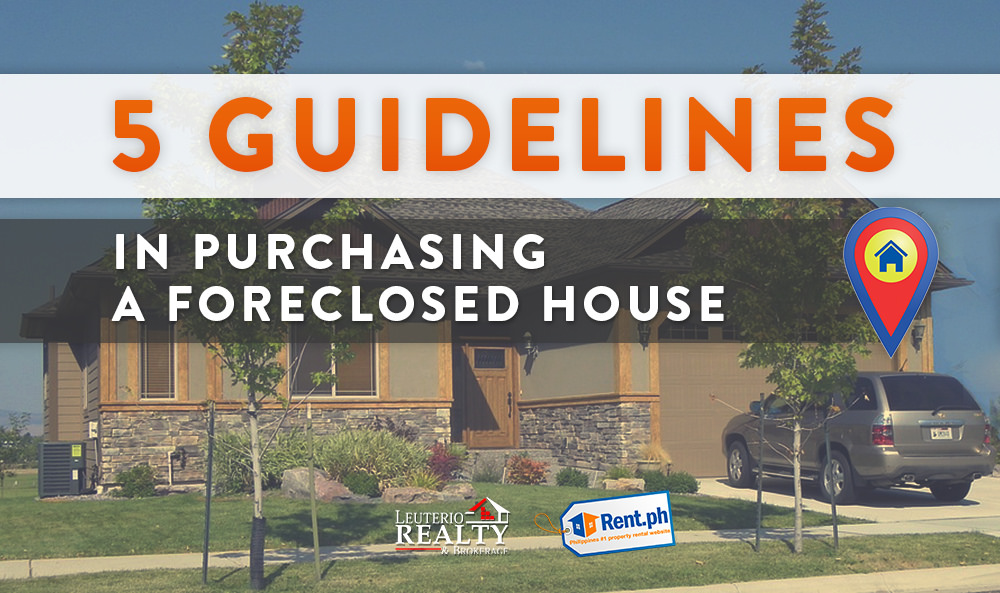

5 Simple Guidelines In Purchasing A Foreclosed House

Foreclosed house. What is it? For starters, it is a property taken back by the lender from the previous owner who was not able to pay the price. It has other terms such as real estate owned (REO) property and bank-owned property.

It may sound like a second-hand house, but be careful. If you are just getting to know the twists and turns on foreclosed houses, it may not be ideal to purchase that kind of house. It is not going to be easy. You may be fascinated with the prices, but you will definitely go through a number of deals before you get the house that you REALLY want. Sometimes, you will just be surprised with the needed repairs

But, if you have the confidence of buying a foreclosed house, then you should know certain points before you take out your money for that property.

- Be cautious about the previous owners

Sometimes, it is hard for them to let go of once was theirs. In some cases, the previous owners still manage to stay inside the house even when the auction has already taken place. When this happens to you, you will have to be patient in getting them out from the house. One of the worst things that can possibly happen? The previous owners would do a major mess, leaving you the responsibility of fixing whatever is needed to be fixed.

- Go bank shopping

A foreclosed house can also be a property that is owned by a bank. This is an easier and less hassle way of looking for houses. You do not have to let anyone out. You also have the opportunity of inspecting the house for damages that might need financing repairs. You just have to find a broker who has connections with banks owning foreclosed houses. There are instances when banks hire brokers to put the foreclosed properties in the market. A bank and a real estate broker? They sound safe and assuring.

- Getting a pre-approval from the lender

This process assures the lender that you are capable of paying the price of the house. What the lender does is to contact your employer, bank, or anyone who is credible enough to know the details of your income, credit, and debt history, if there is any. You will, then, be given a letter that contains the lender’s approval for the commitment you set to pay for the amount within the arranged time. This is playing safe for the lender’s sake. If you want it, make sure that you do your obligation of paying the price.

- No surprises for very low appraisal rates

Most of the time, foreclosed houses are those that are already neglected. Once you go through those houses, don’t be surprised to know that there are no more sources of electricity and water. There is an overgrown backyard, and there are personal properties that are placed over the house. Sometimes, walls have become dirty because of vandals written all over them. Because of these instances, the value of the house can go lower than you expect.

- An extra budget for the maintenance and repair

Before you get too excited, make sure you have set aside a considerable amount of money for the repairs and maintenance of the house. Remember, foreclosed houses are sold in the market WITHOUT ANY RENOVATIONS being done. So, you have to assume that REOs are not in any good condition at all. Banks purposely give lower prices to those properties to let the buyers shoulder the fixing of the damages. If there is way to put the price lower, you can do so. But the banks have already lost so much in their part, so your options are only limited.

Food for thought…

Investing on a house is a decision that must be thoroughly thought through. It should not be taken lightly to the point of just buying whatever is cheaper or enough for the budget.

Foreclosed houses are not a bad idea. However, once you have made the final decision of buying one, you know you will need to work harder to get everything fixed.. It’s going to be fortunate if you got a good-conditioned house, but it’s going to be harder to look for one.

Last tip? Don’t be in a hurry in owning a house. Just choose carefully. Make everything worth it.