Reader Inquiry | Housing Loan for Freelancers

I have been receiving emails from readers lately. And I thought more of you would be pleased reading their concerns and our replies as well. So from now on, we will be answering your inquiries through a blog post so that more people will be able to read it. This letter concerns more about housing loans for home-based online freelance workers.

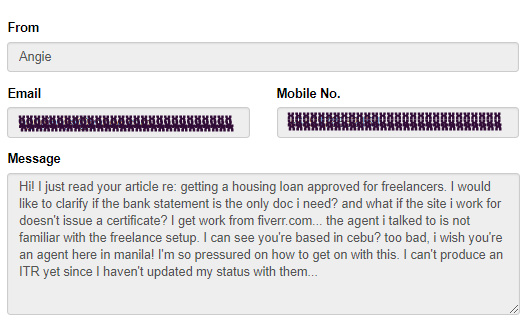

Letter Sender: Angie

Hi! I just read your article re: getting a housing loan approved for freelancers. I would like to clarify if the bank statement is the only doc I need? and what if the site I work for doesn’t issue a certificate? I get work from fiverr.com… the agent I talked to is not familiar with the freelance setup. I can see you’re based in Cebu? too bad, I wish you’re an agent here in Manila! I’m so pressured on how to get on with this. I can’t produce an ITR yet since I haven’t updated my status with them…

My Reply:

Hi Angie,

Happy New Year! I really apologize, I found your inquiry quite late. Are you trying to apply for Bank Loan or Pagibig Loan?

If you are applying for PAGIBIG Loan, you can request for a Certificate of Engagement signed by your barangay captain, that you are in a freelance business and you are residing in that Baranggay and state how much you are earning in your freelance job in a year. Also, state how long have you been doing freelance and that you are receiving income through Paypal/or Bank Transfer or whatever mode of payment you’re using. If you are withdrawing from Western Union, for Example, your transaction receipts can also be used, if you’re using PAYPAL you can print out your transaction history as additional proof and then your 12-month bank statement signed or certified by your bank.

Bank loan has a more strict policy when it comes to loans. They’d really require ITR for housing loans. Update your BIR and claim for a minimum, it’s okay as long as you have ITR. Then your bank statement can support your claims.

They will usually check on cash flow (usually the money-ins) in your account, to see if you are really capable of paying the monthly amortization required for the property.

Happy New Year!