When a property is transferred to an heir in the event of the passing away or death of the original owner, an inheritance tax is paid. Inheritance taxes are calculated based on the fair market value of the property transferred to the beneficiary of the estate.

What is an inheritance tax?

A levy paid by an individual who had inherited a sum of money or a piece of property from another person who just assessed away, this is called Inheritance Tax . The tax amount that the beneficiary pays is dependent location. Tax laws differs between countries. Some laws may define inheritance and estate tax as the same, other define them differently. Estate taxes are generally defined as taxes assessed on the assets or estate of the deceased, while inheritance taxes are assessed on the inheritance received by the beneficiary.

In the Philippines Inheritance Tax and Estate Tax are considered the same. Bureau of Internal Revenue (BIR) defines Estate Tax as:

Estate Tax is a tax on the right of the deceased person to transmit his/her estate to his/her lawful heirs and beneficiaries at the time of death and on certain transfers, which are made by law as equivalent to testamentary disposition. It is not a tax on property. It is a tax imposed on the privilege of transmitting property upon the death of the owner. The Estate Tax is based on the laws in force at the time of death notwithstanding the postponement of the actual possession or enjoyment of the estate by the beneficiary.

How to file Inheritance Tax?

The heirs/authorized representative shall prepare documentary requirements and file the estate tax return (BIR Form 1801) and pay the corresponding estate tax with the Authorized Agent Bank (AAB), Revenue Collection Officer (RCO) or duly authorized Treasurer of the city or municipality in the Revenue District Office having jurisdiction over the place of domicile of the decedent at the time of his death.

How is Inheritance Tax calculated?

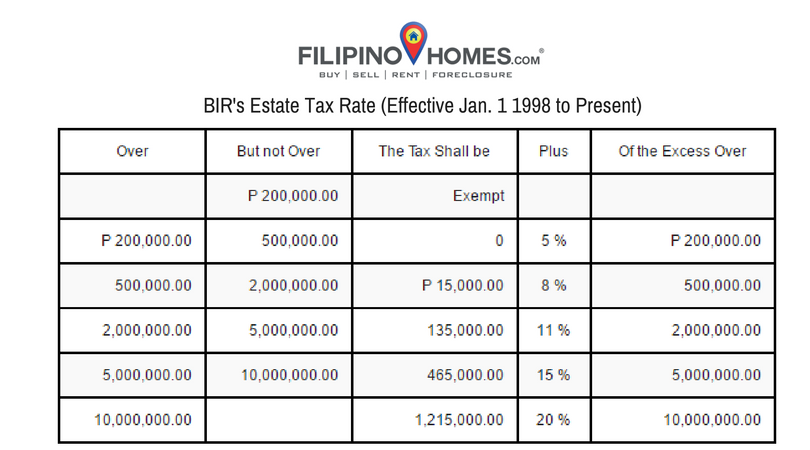

Estate or Inheritance Tax is calculated by determining the value of the deceased net estate. This is done with the difference between the deceased’s gross estate as defined under Section 85 of the Tax Code, and the allowable deductions of the decedent, defined under Section 86. Inheritance Tax is then established using BIR’s Estate Tax Table (Effective Jan 1, 1998 to present).

New Estate = Gross Estate – Deduction

Documentary Requirements

Details may change, please refer to BIR site for updates

- Notice of Death duly received by the BIR, if gross estate exceeds P20,000 for deaths occurring on or after Jan. 1, 1998; or if the gross estate exceeds P3,000 for deaths occurring prior to January 1, 1998

- Certified true copy of the Death Certificate

- Deed of Extra-Judicial Settlement of the Estate, if the estate is settled extra judicially

- Court Orders/Decision, if the estate is settled judicially;

- Affidavit of Self-Adjudication and Sworn Declaration of all properties of the Estate

- A certified true copy of the schedule of partition of the estate and the order of the court approving the same, if applicable

- Certified true copy(ies) of the Transfer/Original/Condominium Certificate of Title(s) of real property(ies) (front and back pages), if applicable

- Certified true copy of the latest Tax Declaration of real properties at the time of death, if applicable

- “Certificate of No Improvement” issued by the Assessor’s Office declared properties have no declared improvement or Sworn Declaration/Affidavit of No Improvement by at least one (1) of the transferees

- Certificate of Deposit/Investment/Indebtedness owned by the decedent and the surviving spouse, if applicable

- Photo copy of Certificate of Registration of vehicles and other proofs showing the correct value of the same, if applicable

- Photo copy of certificate of stocks, if applicable

- Proof of valuation of shares of stocks at the time of death, if applicable:

For listed stocks – newspaper clippings or certification from the Stock Exchange

For unlisted stocks – Audited Financial Statements duly certified by an independent certified public accountant with computation of fair market value per share at the time of death - Proof of valuation of other types of personal property, if applicable

- Proof of claimed tax credit, if applicable

- CPA Statement on the itemized assets of the decedent, itemized deductions from gross estate and the amount due if the gross value of the estate exceeds two million pesos, if applicable

- Certification of Barangay Captain for claimed Family Home

- Duly notarized Promissory Note for “Claims against the Estate” arising from Contract of Loan

- Accounting of the proceeds of loan contracted within three (3) years prior to death of the decedent

- Proof of the claimed “Property Previously Taxed”

- Proof of claimed “Transfer for Public Use”

- Copy of Tax Debit Memo used as payment, if applicable

Additional requirements may be requested for presentation during audit of the tax case depending upon existing audit procedures.