A lot of people say that there are hidden fees when buying a house. This is actually not hidden but you may not have considered them when first entering the property market. This sometimes brings confusion and misunderstanding between sellers and buyers.

This article is only a general guide to help you get your finances ready if your planning to buy a home. Always take into consideration that the total cost of purchasing a home will differ depending on the circumstances of the sale, and how you are financing your home. For this reason, it is very important that you seek the advice of professionals, such as licensed brokers, accountants, or even a lawyer.

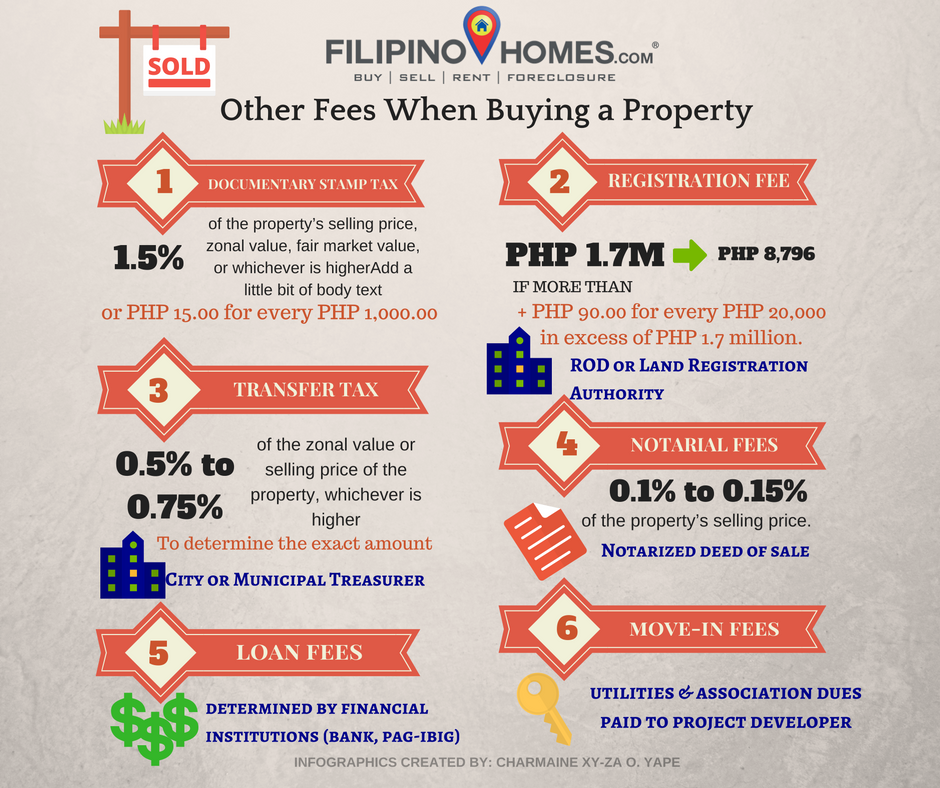

Besides the actual purchase price, the following are the fees and taxes that you as a buyer must also sort out:

Documentary Stamps Tax

The Documentary Stamps Tax (DST) is a type of tax levied on documents, instruments, loan agreements, and papers evidencing the acceptance, assignment, sale, or transfer of an obligation, right, or property. In the case of a sale, a transfer of a real property, or a Deed of Absolute Sale, the tax rate is 1.5 percent or PHP 15.00 for every PHP 1,000.00 of the property’s selling price, zonal value, fair market value, or whichever is higher.

Transfer Tax

This is a tax imposed on any mode of transferring the ownership of a real property, either through sale, donation, or barter. The transfer tax rate varies from a low of 0.5 percent to a high of 0.75 percent of the zonal value or selling price of the property, whichever is higher and depending on the municipality where the property is located. To determine the exact amount, the buyer should consult with the City or Municipal Treasurer.

Registration Fee

This fee is paid for the registration of a Deed of Absolute Sale, conveyance, transfer, exchange, partition, or donation of a real property. It is paid to the local Registry of Deeds or Land Registration Authority where the property is located.

To make the calculation simple, let’s use PHP 1.7 million as the property’s selling price, an amount that incurs a registration fee of PHP 8,796. However, if the property’s selling price exceeds Php1.7 million—for example, PHP 2 million — the buyer will add PHP 90 for every PHP 20,000 in excess of PHP 1.7 million. Hence, the Registration Fee for a property worth PHP 2 million will be PHP 10,146.

Notarial Fees

The Deed of Absolute Sale should be also notarized, which requires a fee of about 0.1 to 0.15 percent of the property’s selling price.

Loan Fees

Lastly, if the buyer applies for a housing loan, there are extra costs tied to it, such as an appraisal fee, handling fee, mortgage redemption insurance, and fire insurance. This depends on the bank or lender, so make sure to shop around to find out who offers the best rate. These fees are collected by the bank or the financing institution like PAG-IBIG HDMF

Move-in Fees

This is a non-government obligation fee. Usually collected by the project developer when your property is ready for move-in or already livable. Move-in fees usually include; connections for utilities, association or subdivision dues and others. To know more about move-in fees click here.

This fees or obligations are not hidden but are usually not included in the prices you see in flyers or marketing materials. Although there are developers or property sellers who started to incorporate this fees to their selling price, this are usually omitted or not included because of the fact that it varies because of many factors.

These fees are collected either mandatory by the government or by the property developer (in the case of move-in fees) or financing institutions. These fees are sometimes hard to digest if you do it alone. Government computations and the process are also stressful. That is why it is best to seek advice from the real estate professionals about this. To search for a real estate professional near you visit Filipino Homes.